Qualify to save ~30% by paying with HSA/FSA

How to check out at Tranquil with HSA/FSA funds

Checking out with Truemed is easy!

Using HSA/FSA funds is easy!

1. Make Your Purchase

- Complete your payment as usual at checkout.

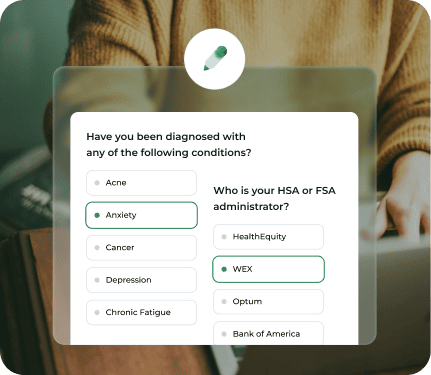

2. Complete Health Assessment

On the order confirmation page, take a quick, private health survey.

A licensed provider will review your answers to determine eligibility.

3. Submit for Reimbursement

If eligible, you’ll get an email in 1–2 days with your Letter of Medical Necessity (LMN) and reimbursement guide.

HSA/FSA claims are usually paid within 1–2 weeks.

How does using my

HSA/FSA save me

money?

How does using my HSA/FSA save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. .

Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

Who is Truemed?

Truemed is our partner that makes it easy to use your pre-tax HSA/FSA funds to purchase eligible products, including our Tranquil GPS Watch.

At Truemed, they believe investing in your health is far more valuable than waiting to spend on sickness. By unlocking HSA/FSA funds on research-backed interventions like fitness, supplements, and health technology, they're shifting healthcare spend toward true medicine.

Who is Truemed?

Truemed is our partner that makes it easy to use your pre-tax HSA/FSA funds to purchase eligible products, including our Tranquil GPS Watch.

At Truemed, they believe investing in your health is far more valuable than waiting to spend on sickness. By unlocking HSA/FSA funds on research-backed interventions like fitness, supplements, and health technology, they're shifting healthcare spend toward true medicine.

Eligible Products

Common Questions

What can I buy with HSA/FSA through Truemed?

You can use your HSA/FSA funds to get reimbursed for the purchase of the Tranquil GPS Watch. The subscription plan and accessories are not eligible for reimbursement, only the watch itself.

How does using my HSA/FSA account save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).

What are FSA and HSA accounts?

Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses.

If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

Can I use Truemed's services for past purchases?

While this depends on your specific HSA or FSA administrator’s policies, we advise that you only submit expenses incurred on or after the date listed on your Letter of Medical Necessity.

What is a Letter of Medical Necessity, and how is this compliant?

Many plans require this letter to approve reimbursement. When you complete our short health survey after purchase, a licensed provider reviews your answers and issues an LMN if appropriate.

When should I use my FSA/HSA dollars?

You can use your HSA/FSA dollars all year long. However, FSA dollars expire at the end of the year and unused money may not rollover into the next year.

Make sure to spend the rest of your FSA dollars before December 31st — use it, so you don’t lose it!

How long does it take for me to receive my Letter of Medical Necessity?

For most FSA/HSA administrators, your expenses will be approved within days when you submit your claim for reimbursement along with your receipt and a Letter of Medical Necessity. The exact timing will vary based on your administrator.

I don’t have an HSA/FSA. Can I still benefit from Truemed?

Truemed’s services are designed for individuals with HSA or FSA accounts. If you don’t have one, check with your employer to see if you’re eligible to open an account.

I don’t live in the U.S. Can I still get reimbursed with Truemed?

Currently, Truemed is available only in the United States.

What happens if I don’t use my FSA funds?

Unused FSA funds typically do not roll over, so it’s important to plan your spending before the year ends